By Nicole NeSmith, CARPLS Development & Communications Associate

Before the pandemic, CARPLS’ staff was already committed to providing free legal help to anyone in need. Many members of our team are responding to the COVID-19 pandemic in creative ways over and above their hotline shifts. CARPLS has always been there to help people in crisis, and now is no different.

Facing It Together Head On

Aleida Lozano-Netzel, CARPLS Staff Attorney, sews masks for her family, friends, and the medical community.

“My daughter-in-law is a nurse, and I have other family in the medical field, so I felt I had to do something,” Aleida says. “We’re stuck inside the house, so it’s also been a good distraction.”

To make masks, she’s used leftover Army fabric from when her son was at West Point and ordered fabric from Joann’s delivered by no contact. “The hardest part has been finding enough elastic,” she says. Because of the shortage, she’s resorted to using shoelaces, hair ties from the dollar store, and jewelry elastic. She also uses furnace filters as inserts for the masks, and her husband has lent a helping hand by doing the wire cutting. It takes her about 20 minutes to make a mask—after a few days, she had already made 30.

“There is a need there for the masks, and there’s a vested interest,” she says. “It means I’m doing what I should be doing. It’s like wartime. People did what they had to do. We all need to pull together and unite. We need to support others.”

Mary Jo Rosso, CARPLS Staff Attorney, relates to Aleida’s ingenuity with her sewing materials. Mary Jo started out by sewing a dozen masks for a friend who is a healthcare worker in Massachusetts facing supply shortages. “I ran out of elastic, and that stuff is as hard to find as toilet paper! Eventually, my sister gave me some elastic and my mother-in-law dug some up, I found tape at Joann’s, and I’m scraping things together. It’s an ordeal.”

She continued to make masks “with a slow trickle” and is selling them for $10 each, with the full proceeds going to WINGS Program, the largest domestic violence service provider in Illinois.

“It’s a cause important to me, and with people sheltering in place, people are especially vulnerable,” Mary Jo says. “WINGS operates resale stores to fund its operations and those are closed due to COVID-19, so they seemed especially in need of other funding at this time.”

Mary Jo has so far raised nearly $1500! “There’s demand causing me to order more supplies!”

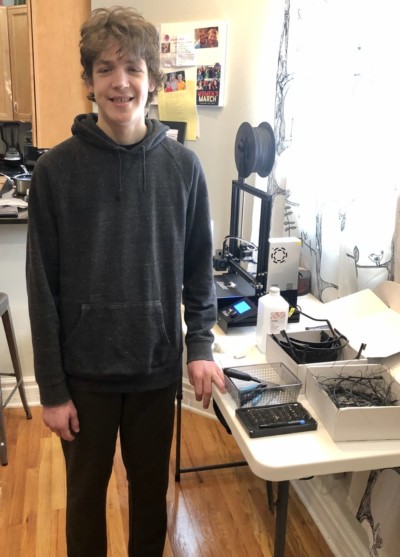

Melissa Wemstrom, CARPLS Supervising Attorney, has been helping her 15-year-old son make face shields for health care workers. In late March, they watched a “Chicago Tonight” segment on WTTW that showed a mother-son duo using 3D printers to make the shields.

“It was 100% my son Jonah’s idea that we should do this in our home,” Melissa says. “We didn’t have a 3D printer, but Jonah ordered parts and figured out how to build a 3D printer and configure it for making face shields. He described it as ‘building a new Lego project with lots of different instructions.’”

They joined a Facebook group that is dedicated to making face shields using a 3D printer.

“My only role is to flip the ‘on switch’ to start the morning manufacturing, because I’m the first one awake at 6am,” she says. “For a while, everything spread out all over the dining room table, so we got organized and created a shield-making station on a folding table against the wall.”

The Facebook group coordinates the drop-off and distribution of the face shields, so it’s a community effort.

“Once we started doing this, I realized how many people are making PPE in their own homes,” Melissa says. “It’s very sobering that the PPE shortage creates a need for this, but it’s incredibly inspiring to see people from all different backgrounds, often with no experience, do something to help our health care workers.”

We Don’t Have To Look Far To Find People In Need

Shama Ahmed, CARPLS Staff Attorney, is working with a group at Chicago Muslim Athletics to donate items to a drive organized by Women’s Justice Institute. The drive is for a woman who was released from a Chicago-area jail due to COVID-19 issues.

“She is pregnant and has other children and has no funds and, of course, no job; so we are just trying to send her baby/hygiene/food items to make life a bit easier while she’s out on electronic monitoring during the pandemic,” Shama says.

After the shelter in place order went into effect, Pat Wrona, CARPLS Legal Director, happened to be talking to her upstairs neighbor (from six feet away), and found out the entire family of a mom, dad, and two grown children had all lost their jobs or been laid off due to COVID-19. She filled them in on how to apply for unemployment, let them know about the $600 per week federal “boost” that had just been enacted, that they all should also receive, and told them about the $1200 CARES Act federal stimulus cash payment they would all also be eligible for.

“They all reacted like it was Christmas morning, and I was Santa Claus! In one conversation, doing what I do every day at CARPLS, I was happy to know I helped one family go from financial doom and worry, to realizing they are going to be okay!”

Pat also noted that we can’t forget our senior citizens during this crisis. “Those who are living in nursing homes and assisted living have been living in quarantine for even longer than the rest of us and are lonely and afraid. I have an elderly friend who I visit once a week to help with her ‘bills and pills’ and now we are talking virtually and finding other arrangements to pay her monthly bills during the crisis. We have to get creative to deal with this unusual situation.”

Thank you to everyone who is helping others in these uncertain times. We hope that you are also finding time to take care of yourself and your family.